Bitcoin is the Best Unit of Account

In an earlier article, I conceded too much and suggested that Bitcoin doesn’t need to be a unit of account. What I should have said is that Bitcoin is a great unit of account—much better than the dollar.

The objection that Bitcoin is not a good unit of account actually hides a circular argument that invalidates it. Bitcoin’s utility as a unit of account depends on what you already believe about Bitcoin. If you are skeptical of Bitcoin, then it makes no sense to use Bitcoin as a unit of account. If you believe that Bitcoin will become the world currency, then it makes no sense to use anything else. You want to end up with as many bitcoins as possible, so it makes sense to price any investments or ventures in Bitcoin. That’s how you know if you are winning or losing against your benchmark. Thus, to say that Bitcoin will fail because it is a bad unit of account is to say nothing more than that it will fail because it will fail.

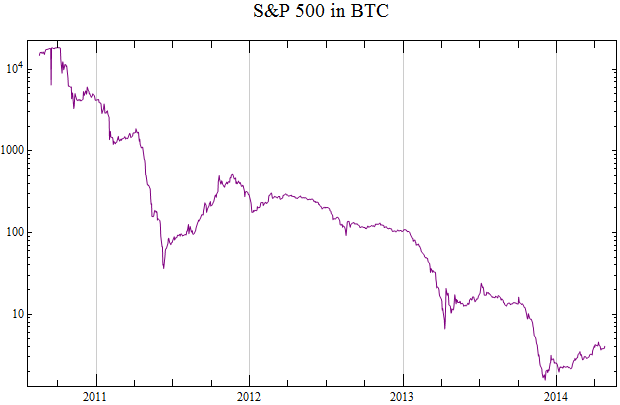

There is, of course, no objective unit of value that is measured with a unit of account. This is why it is possible for two people to prefer such wildly different behaviors from their units of accounts. Someone still lost in the dollar world looks at Bitcoin and sees wild and extreme volatility, whereas someone in Bitcoin looking back at the dollar sees the worst and longest economic crash in history.

Upon entering the Bitcoin world, one gradually realizes that dollars make a lot less sense in this new world. Suppose, for example, that one considers getting into Bitcoin mining. The most important question is whether the mining rigs will mine more bitcoins than they cost—dollars don’t enter into question at all. Other businesses that perform Bitcoin-related services also must think similarly because one must always ask for any investment in the business, did it earn as many bitcoins as it cost to create?

Ok, so sure Bitcoin accountancy works within Bitcoin, what about interacting with the rest of the world? This also works fine. In fact, it works great. It just means that all prices in Bitcoin are rapidly falling. What’s the problem with that? That’s just Bitcoin’s way of telling people to keep holding it. It just feels like everything is becoming rapidly cheaper. Not a bad feeling. Not bad at all!

I feel like I went through a subtle psychological shift recently. When I use dollars, they feel like play money to me. Buying with them feels like using the colorful foreign cash during a vacation overseas. It no longer feels quite like real money. Bitcoin is my unit of account.

Addendum (July 15, 2016)

An observation I made today upon investigating something interesting happening in current events is that the price of ethers as listed on ethereumwisdom.com is listed first in Bitcoin, second in U.S. dollars. This is interesting, and a little ironic (in the sense of a player in a drama who does something without understanding its full significance) because it means Bitcoin is seen as the primary unit of account for the people investing in ethers. This reddit post also suggests that Bitcoin is like a unit of account for these people.

I guess Bitcoin must not be such a terrible unit of account if that’s what people are using it for. I want to talk a little about why this might happen.

In the short term, cryptocurrencies tend to trade against the dollar in the same way. If Bitcoin prices rise or fall against the dollar, then other cryptocurrencies will tend to move similarly. From the standpoint of someone trying to choose between Ethereum and Litecoin, the price changes common to all cryptocurrencies are uninteresting. If the prices of ethers and litecoins are compared in terms of a common denominator which moves with them, then their similarities are less evident and their differences more evident. A specialist would want to look at them in the way that most emphasizes their differences.

Investors have chosen to do this by comparing prices in terms of Bitcoin. This makes perfect sense. Among people who think cryptocurrencies are going to be a big deal, you really want to compare everything to Bitcoin because it’s the most obvious winner here. The irony is that once you start using Bitcoin as your unit of account, then you’re using it like money, which means that you’re not using your altcoin investments as money, which is the only thing they’re good for.

I really like this development because it shows that people are getting more skeptical. The more people start to compare everything in terms of Bitcoin, the more they’ll start to demand something that’s actually useful. “Yes, but is it really going to beat Bitcoin?” is the question everyone should ask first about any investment in the Bitcoin world.

Read in Español