Chapter Two

Bitcoin, Not Blockchain

(Originally published on 6 September 2019)

Parsing the Landscape

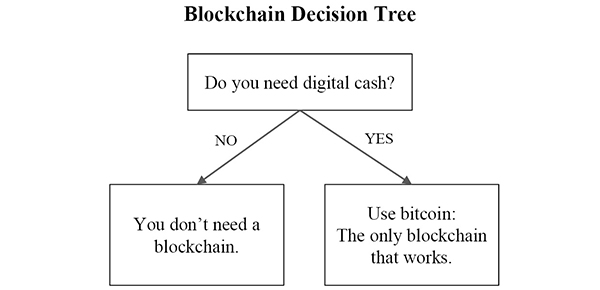

Have you ever heard a smart-sounding person say that they are not sure about bitcoin but believe in blockchain technology? The stance is common and has given rise to the popular but misinformed narrative that “Blockchain, Not Bitcoin” is the real innovation. The idea that ‘blockchain’ technology is valuable but not bitcoin is the equivalent of saying you believe in airplanes but are unsure about the wings. And anyone who holds this view unknowingly communicates that he or she does not understand either.

Bitcoin and its blockchain are dependent on each other. However, for those new to bitcoin, understanding how it works and parsing the landscape can be overwhelming. Given the complexity and sheer volume of noise, who has the time to evaluate everything thoroughly? A more manageable path exists, but you have to know where to start. While there are seemingly thousands of cryptocurrencies and blockchain initiatives, there is really only one that matters: bitcoin. If you want to understand bitcoin or anything tangentially related, ignore everything as if it did not exist and try first to understand why bitcoin exists and how it works. That is the best foundation from which to then consider the entirety of everything else.

Setting biases aside, bitcoin is also the most practical entry point. There is no promise that you will come to the same conclusion that bitcoin is the fundamentally valuable innovation, but more often than not, those who take the time to intuitively understand how and why bitcoin works are more easily able to recognize the flaws inherent in other blockchain projects. And even if not, starting with bitcoin remains your best hope of making an informed and independent assessment. Ultimately, bitcoin is not about making money and it’s not a get-rich-quick scheme. It is fundamentally about storing the value you have already created, and no one should risk that without a requisite knowledge base. Within the world of digital currencies, bitcoin has the longest track record to assess and the greatest number of resources to educate, which is why bitcoin is the best tool to learn.

Michael Caras, Bitcoin Money (2019); Saifedean Ammous, The Bitcoin Standard (2018); Yan Pritzker, Inventing Bitcoin (2019); Andreas Antonopoulos, Mastering Bitcoin (2017); Jimmy Song, Programming Bitcoin (2019).

To start on this journey, first realize that bitcoin was created to specifically address a problem with modern money. The inventor of bitcoin set out to create a peer-to-peer digital cash system without the need for a trusted third party, and a blockchain was one critical part of the solution. In practice, bitcoin (the currency) and its blockchain are interdependent. One does not exist without the other. Bitcoin needs its blockchain to function, and there would not be a functioning blockchain without a native currency (bitcoin) to incentivize resources to protect it adequately. That native currency must be viable as a form of money because it is exclusively what pays for security, and it must have credible monetary properties in order to be viable.

Without the money, there is no security. And without the security, the value of the currency and the integrity of the data recorded by a blockchain both break down. For this reason, a blockchain is only useful within the application of money, and money does not magically grow on trees. It really is that simple. A blockchain is only good for one thing, removing the need for a trusted third party, which only works in the context of money. A blockchain cannot enforce anything that exists outside the network. While a blockchain would seem to be able to track ownership outside the network, it can only enforce ownership of the currency that is native to its network. Bitcoin tracks ownership and enforces ownership. If a blockchain cannot do both, any records it keeps will be inherently insecure and ultimately subject to change. In this sense, immutability is not an inherent trait of a blockchain but instead, an emergent property. And if a blockchain is not immutable, its currency will never be viable as a form of money because transfer and final settlement will never be reliably possible. Without reliable final settlement, a monetary system is not functional and will not be adopted nor attract liquidity through exchange.

Monetary systems converge on one medium because their utility is liquidity and exchange rather than consumption or production. The market for exchange, and ultimately liquidity, consolidates around the form of money that is the most secure, long-term store of value. It would be irrational to store wealth in a less secure, less liquid form of money if a more secure, more liquid network existed as an accessible option. The aggregate implication is that only one blockchain is viable and ultimately necessary. Every other cryptocurrency is competing for the identical use case as bitcoin, that of money. Some realize it, while others do not. Regardless, value continues to consolidate around bitcoin because it has the most secure blockchain by orders of magnitude—the one least susceptible to arbitrary or unexpected change. Understanding these concepts is fundamental to bitcoin and provides a foundation to then consider and evaluate the noise beyond bitcoin. With a rudimentary knowledge of how bitcoin works, it becomes clear why there is no blockchain without bitcoin.

There Is No Blockchain

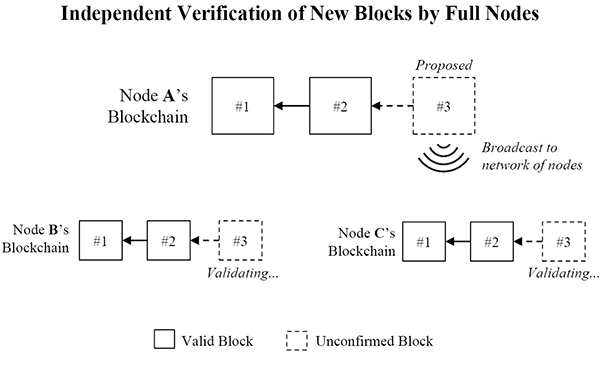

Bitcoin’s transaction ledger is often thought of as a public blockchain that lives somewhere in the cloud, like a digital public square where all transactions are aggregated. However, there is no central source of truth. There are no oracles, and there is no central public blockchain to which everyone independently commits transactions. Instead, every participant within the network constructs and maintains its own independent version of the blockchain based on a common set of rules. No one trusts anyone and everyone validates everything. Participants are able to come to the same version of the truth without having to trust any other party. This is core to how bitcoin solves the problem of removing third-party intermediaries from a digital cash system in the validation and final settlement of exchange.

Every participant running a node within the bitcoin network verifies every transaction and every block independently. In doing so, each node aggregates its own independent version of the blockchain. Consensus is reached across the network because each node validates every transaction (and block) based on a common set of rules whereby the longest valid chain is recognized. If a node broadcasts a transaction or block that does not follow consensus rules, other nodes will reject it as invalid. Through this function, the bitcoin network is able to converge on the same consistent state of ownership and dispose of the need for a central third party. However, the currency plays an integral role in coordinating bitcoin’s consensus mechanism and ordering blocks, which ultimately represent bitcoin’s complete and valid transaction history (or its blockchain).

Blocks and Mining

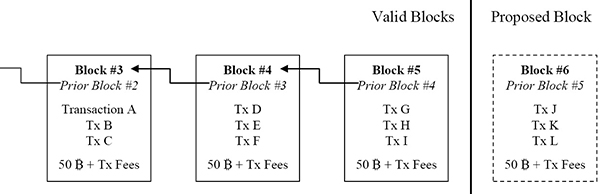

Think of a block as a dataset that links the past to the present. Technically, individual blocks record changes to the overall state of bitcoin ownership within a given time interval. In aggregate, blocks record the entire history of bitcoin transactions and, therefore, ownership of all bitcoin at any point in time. Only changes to the state of ownership are recorded in each passing block. How blocks are constructed, solved, and validated is critical to the process of network consensus, which also ensures that bitcoin maintains a fixed supply of 21 million. Miners compete to construct and solve blocks, proposing valid blocks to the rest of the network for acceptance. Think of the mining function as a continual process of validating history and clearing pending bitcoin transactions. Because bitcoin is permissionless, anyone can contribute resources to the mining function, but typically, bitcoin miners are run as specialized businesses. With each block, miners add new transaction history to the blockchain and validate the entire history of the chain. Miners secure the network through this function. However, all network nodes then subsequently check the work performed by miners for validity, ensuring network consensus is enforced. More technically, miners construct blocks that include three critical elements (simplified for clarity):

- Reference to the prior block (validate the entire history of the chain)

- Bitcoin transactions (clear pending transactions, i.e., changes to the state of ownership)

- Coinbase transaction and transaction fees (compensation to miners for securing the network)

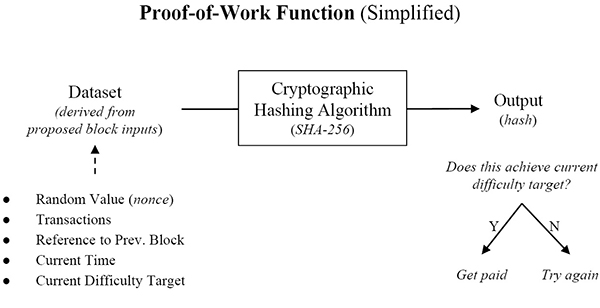

Miners solve blocks by expending energy resources to perform what is known as a proof-of-work function. For blocks to be valid, all inputs must be valid, and each block must satisfy the current network difficulty, which is directly tied to the then aggregate amount of energy resources securing the network. As more resources secure the bitcoin network, the network difficulty increases and the network becomes more secure, rather than the terminal supply of the currency increasing. To satisfy the network difficulty, a random value (referred to as a “nonce”) is added to each block, and then the combined dataset is run through bitcoin’s native cryptographic hashing algorithm (SHA-256). The resulting output (or hash) must achieve the network’s difficulty in order to be valid. Think of this as a simple “guess and check” function, but probabilistically, trillions of random values must be guessed and checked in order to create a valid proof for each proposed block. The addition of a random nonce may seem extraneous. But this function is what forces miners, by design, to expend significant energy resources in order to solve a block, which ultimately makes the network more secure by making it extremely costly to attack.

Adding a random nonce to a proposed block, which is an otherwise static dataset, causes each resulting output (or hash) to be unique. Imagine a dataset being changed a trillion times, by just changing one single random number in the dataset each time. Everything else but the random nonce remains the same. With each nonce checked, the resulting output has an equally small chance of achieving the network difficulty (i.e., representing a valid proof). While this process is often referred to as solving a highly complicated mathematical problem, in reality, it is difficult only because a valid proof requires guessing and checking trillions of possible solutions. There are no shortcuts. Energy must be expended. A valid proof is easy to verify by other nodes but probabilistically impossible to solve without expending a massive amount of resources. As more mining resources are added to the network, the network difficulty increases, requiring more inputs to be checked and more energy resources to be expended to solve each block. Essentially, miners face a material cost in solving blocks, but it remains trivial for all other nodes to validate the work at practically no cost.

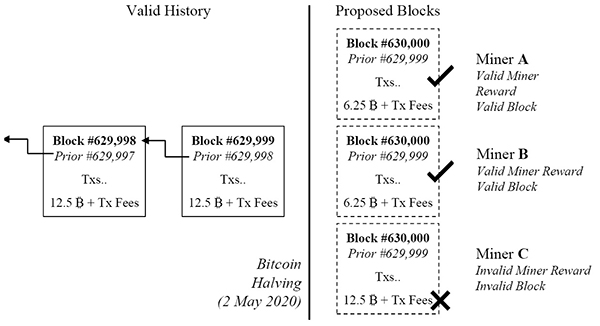

In aggregate, the incentive structure allows the network to reach consensus. Miners must incur significant up-front costs to secure the network but are only paid if valid work is produced. The rest of the network can immediately determine whether work is valid or not based on consensus rules. While there are many consensus rules that determine whether a block is valid or not, if any pending transaction in a block is invalid, the entire block is invalid. For a transaction to be valid, it must have originated from a previously valid bitcoin block, and it cannot be a duplicate of a previously spent transaction. Separately, each block must build off of the most up-to-date version of history and include a valid coinbase transaction. A coinbase transaction rewards miners for producing valid work with newly issued bitcoin in return for securing the network (i.e., for enforcing the fixed supply and verifying valid transactions).

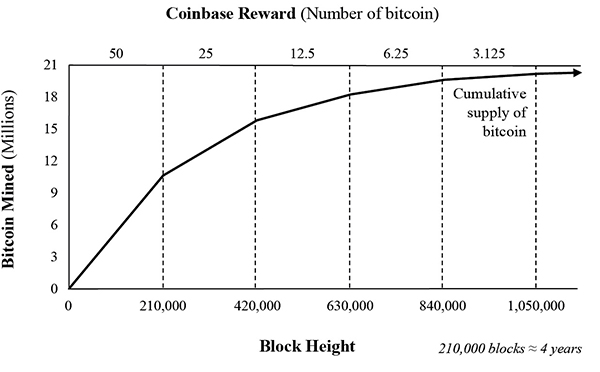

Coinbase rewards are governed by a predetermined supply schedule. At the time of writing, 12.5 new bitcoin are issued in each valid block, and the reward will be cut in half to 6.25 new bitcoin in approximately eight months. Every 210,000 blocks (or approximately every four years), the coinbase reward is reduced by half until it ultimately reaches zero. If miners include an invalid reward in a proposed block, the rest of the network will reject it as invalid. This is the base mechanism that governs bitcoin’s capped total supply of 21 million. However, software alone is insufficient to ensure either a fixed supply or an accurate transaction ledger. Economic incentives hold everything together.

Consensus on a Decentralized Basis

Within one integrated function, miners validate history, clear transactions, and get paid for security on a trustless basis. The integrity of bitcoin’s fixed supply is embedded in its security function. Because the rest of the network independently validates the work, consensus can be reached on a decentralized basis. If a miner completes valid work, the miner can rely on the fact that it will be paid on a trustless basis. Conversely, if a miner completes invalid work, the rest of the network enforces the rules, essentially withholding payment until valid work is completed. And the supply of the currency is baked into validity. If a miner wants to be paid, the miner must also enforce the fixed supply of the currency, further aligning the entire network. The incentive structure of the currency is so strong that everyone is forced to adhere to the rules, which is the chief facilitator of decentralized consensus.

If a miner solves and proposes an invalid block, specifically one that either includes invalid transactions or an invalid coinbase reward, the rest of the network will reject it as invalid. Separately, if a miner builds off of a version of history that does not represent the longest chain with the greatest proof-of-work, any proposed block would also be considered invalid. Essentially, as soon as a miner sees a new valid block proposed in the network, it must immediately begin to work on top of that block (with a block height plus one) or risk falling behind and performing invalid work at a sunk cost. Consequently, in either scenario, if a miner were to produce invalid work, the miner would incur real costs but receive no compensation in return.

Through this mechanism, miners are financially incentivized at all times to work within the consensus of the chain to produce valid work. It is also why the higher the cost to perform the work, the more secure the network becomes. The more energy required to write or rewrite bitcoin’s transaction history, the lower the probability that any single miner could (or would) be able to undermine the network. The incentive to cooperate increases as it becomes more costly to produce work that would otherwise be considered invalid by the rest of the network. As network security increases, bitcoin becomes more valuable. As the value of bitcoin rises and as the cost to solve blocks increases, the incentive to produce valid work increases (more revenue but more cost), while the penalty for invalid work becomes more punitive (no revenue and more cost).

Why don’t some miners collude to undermine the network? First, they can’t. Second, they tried.[4] And third—the fundamental reason—as the network grows, it becomes more fragmented, and the economic value compensated to miners in aggregate increases. From a game-theory perspective, more competition and greater opportunity cost make it harder to collude. All the while, network nodes validate the work performed by miners, which acts as a constant check and balance. Miners are merely paid to perform a service, and the more miners there are, the greater the incentive to act in the interests of the network because the probability that a miner is penalized for invalid work increases as more competition exists. And recall that random nonce value. It seemed extraneous at the time, but it is core to the function that requires energy resources be expended. This tangible cost gives miners skin in the game. And when combined with the value of the currency, it is what incentivizes valid work and allows the network to reach consensus.

Because miners are maximally penalized for invalid work and all network nodes independently validate blocks, the network is able to form a consensus as to the accurate state of the chain without relying on any single source of knowledge or truth. None of this decentralized coordination would be possible without bitcoin, the currency. The bitcoin network only has its native currency to compensate miners in return for security, whether that is largely in the form of newly issued bitcoin today or exclusively in the form of transaction fees in the future. If the compensation paid to miners were not reasonably considered to be a reliable form of money, the incentive to make the investments to perform the work would not exist.

The Role of Money in a Blockchain

Recall from “Bitcoin Obsoletes All Other Money*”* that if an asset’s primary (if not sole) utility is in its exchange for other goods and services, and if it does not have a claim on the income stream of a productive asset (e.g., a stock or bond), it must compete as a form of money and will only store value if it possesses credible monetary properties. Bitcoin is a bearer asset, and it has no utility other than the exchange for other goods or services. It also has no claim on the income stream of a productive asset. Bitcoin is only valuable as a form of money and holds value because it has credible monetary properties. The only thing any blockchain can offer in return for security is a monetary asset native to the network, and one without any enforceable claims outside the network. This is why a blockchain can only be useful in connection to the application of money.

Without a native currency, a blockchain must rely on trust—i.e., the intervention of one or more third parties—for security, which eliminates the need for a blockchain in the first place. The security function of bitcoin (i.e., mining), which protects the validity of the chain on a trustless basis, requires significant up-front capital investment and ongoing marginal costs in the form of energy consumption. To recoup that investment and provide a rate of return in the future, the payment in the form of bitcoin must more than offset the aggregate costs. If it were not expected to do so, such investments would not be made. Essentially, what miners are paid to protect (bitcoin) must be a reliable form of money to incentivize security investments.

Source: The Bitcoin Standard by Saifedean Ammous

This is also fundamental to the incentive structure that aligns the network. Miners have an embedded incentive not to undermine the network because it would directly undermine the value of the currency in which miners are exclusively compensated. If bitcoin were not valued as money, there would be no miners, and without miners, there would be no chain worth protecting. The validity of the chain is what miners are paid to protect. If the network could not adequately come to a consensus and ownership were subject to change, no one could reasonably rely on bitcoin as a value-transfer mechanism. The value of the currency ultimately protects the chain, and the chain’s immutability is foundational to the currency having value. It’s an inherently self-reinforcing relationship.

Immutability Is an Emergent Property

As mentioned earlier, immutability is an emergent property in bitcoin, not an inherent trait of a blockchain. A global, decentralized monetary network with no central authority could not function without an immutable ledger (i.e., if the history of the blockchain were insecure and subject to change). If settlement of the unit of value (bitcoin) could not reliably be considered final, no one would be willing to trade real-world value in return. As an example, consider the sale of a car in exchange for bitcoin. Assume the buyer takes physical possession of the car, and the car’s title is successfully transferred. If bitcoin’s record of ownership could easily be rewritten or altered (i.e., if the history of the blockchain could be changed), the buyer could wind up in possession of both the car and the bitcoin, while the seller could end up with neither. This is why immutability and final settlement are critical to bitcoin’s function.

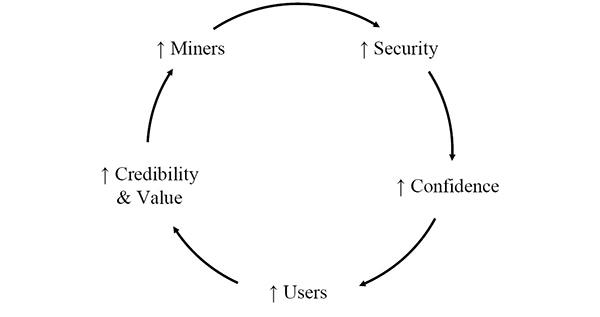

Recall that bitcoin has no knowledge of the outside world. It only “knows” how to issue and validate currency. Bitcoin is an entirely self-contained system and is not capable of enforcing anything that exists outside the network (nor is any blockchain). For this reason, the bitcoin network can only ever validate one side of a two-sided value transfer. If bitcoin transfers could not reliably be considered final, it would be functionally impossible to trade anything of value in return for bitcoin. Hence, the immutability of bitcoin’s blockchain is inextricably linked to the value of bitcoin as a currency. Final settlement in bitcoin is only possible because its ledger is reliably immutable. And its ledger is only reliably immutable because its currency is valuable. The more valuable bitcoin becomes, the more security it can afford. The greater the security, the more reliable and trusted the ledger.

Immutability is an emergent property dependent on other emergent network properties. As bitcoin becomes more decentralized, it becomes increasingly difficult to alter the network’s consensus rules or to invalidate or prevent otherwise valid transactions (i.e., censorship resistance). As bitcoin proves to be increasingly censorship-resistant, confidence in the network grows, fueling adoption, which further decentralizes the network, including its mining function. In essence, bitcoin becomes more decentralized and more censorship-resistant as it grows, which reinforces the immutability of its blockchain. It becomes increasingly difficult to change the history of the blockchain because each participant gradually represents a smaller and smaller share of the network. Regardless of how concentrated ownership of the network and mining may be at any point in time, both decentralize over time so long as value increases, which causes bitcoin to become more and more immutable.

Bitcoin, Not Blockchain

Bitcoin’s multidimensional incentive structure may be complicated, but it is critical to understand how bitcoin works and why bitcoin and its blockchain are interdependent. Each is a tool that relies on the other. Without one, the other is effectively meaningless. It is a symbiotic relationship that only works in the application of money.

Bitcoin as an economic good is only valuable as a form of money because it has no other utility. This is true of any asset native to a blockchain. The only value bitcoin can ultimately provide is through present or future exchange. And the network is only capable of a single aggregate function: validating whether a bitcoin is a bitcoin and recording ownership over time.

The bitcoin network is an entirely independent, closed-loop system. Its only connection to the physical world is through its security and clearing function (mining and proof-of-work). The blockchain maintains a record of ownership, and the currency is used to pay for the security of those records. Through the value of its currency, the network can afford a level of security to ensure the immutability of the blockchain. As a result, network participants can consistently reach consensus without the need for trust in any third parties. The cumulative effect is a decentralized and trustless monetary system with a fixed supply that is global in reach and accessible on a permissionless basis.

Every fiat currency, commodity money (e.g., gold), and cryptocurrency is competing for the exact same use case as bitcoin, whether it is consciously understood by market participants or not. Bitcoin is valuable because, in aggregate, it has achieved finite scarcity. Scarcity is the backbone of why bitcoin is secure as a monetary network, and it is a property that is dependent on many other emergent properties.

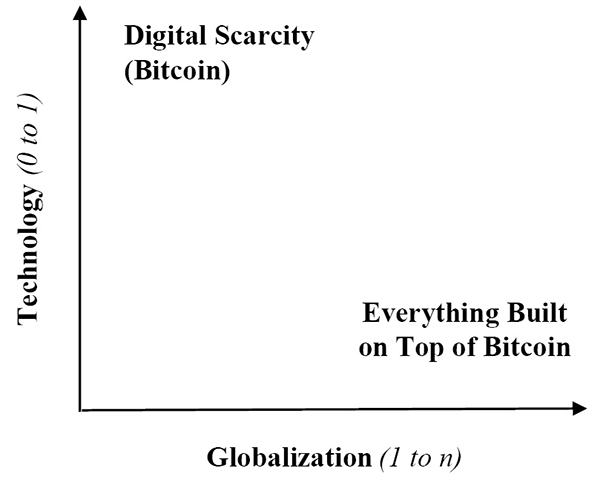

Inspired by Zero to One by Peter Thiel (2014)

A blockchain, on the other hand, is simply an invention native to bitcoin that enables the elimination of trusted third parties in a closed-loop monetary system. It serves no other purpose. It is only valuable in bitcoin as one piece to a larger puzzle and would be useless if it did not function in concert with the currency. The integrity of bitcoin’s scarcity and the immutability of its blockchain are ultimately dependent on the value of the currency itself. Confidence in the aggregate function drives incremental adoption and liquidity, which reinforces and strengthens the value of the bitcoin network as a whole. As individuals opt in to bitcoin, they are simultaneously opting out of inferior monetary networks. This is fundamentally why the emergent properties in bitcoin are next to impossible to replicate and why its monetary properties become stronger over time (and with greater scale), all at the direct expense of inferior monetary networks.

Ultimately, a blockchain is only useful in the application of money because it is dependent on a native currency for security. All other blockchains are competing for the same fundamental use case. Bitcoin represents the most secure blockchain by orders of magnitude, and no other digital currency can compete because bitcoin’s network effects only continue to increase its security and liquidity advantage over the field. Liquidity begets liquidity, and monetary systems converge to one medium as a derivative function.

The real competition for bitcoin has been, and will remain, the legacy monetary networks—principally the dollar, euro, yen, and gold. Think about bitcoin relative to these legacy monetary assets. Bitcoin does not exist in a vacuum; it represents a choice relative to other forms of money. Evaluate it based on the relative strengths of its monetary properties, and once a baseline is established between bitcoin and the legacy systems, this will then provide a strong foundation to more easily evaluate any other blockchain-related project.

-

Phil Geiger, “Bitcoin Refuses to Centralize,” Keeping Stock (blog), Medium, 27 August 2018. ↩