Chapter Ten

Bitcoin Is Not for Criminals

(Originally published on 29 November 2019)

Not Inherently Criminal

If you happen to believe (or[]{#_idTextAnchor125} have ever heard) that bitcoin is primarily a tool used by criminals, stop and take a quick inventory of friends and family that you know or suspect may own bitcoin. How many are known criminals? While there have been widely publicized cases of criminals using bitcoin, a certain class of bitcoin skeptic assumes this must be its primary use case. The inference is generally founded upon the belief that bitcoin is inferior to the dollar, either because it is too volatile or too slow to be widely accepted for day-to-day transactions. With this flawed mental framework, the logical explanation becomes that someone would only use bitcoin to facilitate some illicit activity, generally as a means of evading law enforcement. Your favorite senator or Treasury secretary may occasionally make such a claim, but thankfully, it is not true. Bitcoin is not for criminals. It is, however, for everyone.

The clear ends of Bitcoin for either transacting in illegal goods and services or speculative gambling make me wary of its use.

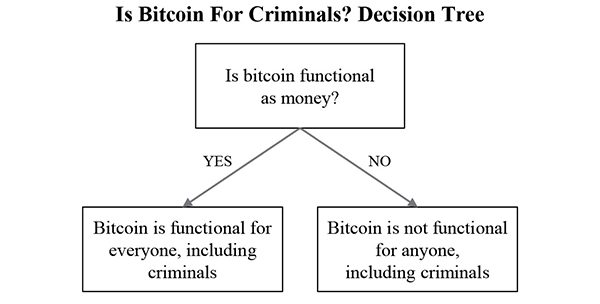

If bitcoin were principally used for illicit purposes, it may more logically follow that bitcoin is primarily used by criminals. Because it is not, the typical follow-on arguments that bitcoin should be banned to prevent such activity similarly do not hold water. The foundation of the idea is based on the false premise that bitcoin is inferior to the dollar when in fact, it is superior to any form of money that has previously existed, principally as a function of its fixed supply. Bitcoin’s fixed supply forms the basis of the fundamental demand for bitcoin, whether it be related to criminal activity or otherwise. Without a doubt, bitcoin is most definitely used by the likes of drug dealers and other nefarious characters on the dark web. However, it would be irrational to extrapolate this as its primary use or to believe that bitcoin should be banned as a result. It is logically inconsistent to form a view that bitcoin is viable as a currency for criminals, while at the same time denying the implication that such a view would establish that bitcoin is functional for everyone.

Before turning the drugs narrative upside down, let’s first recognize that criminals rely on any number of commonly trafficked tools and not just bitcoin: roads, the internet, the postal service, airports, the banking system, etc. All are used by criminals and often to facilitate crimes. However, criminals use each for personal, noncriminal activities too. And that is where the logic that bitcoin must be banned because it enables criminal activity completely breaks down. Crimes are crimes. There is nothing inherent in the tools used when committing a crime that makes them criminal. Using the postal service to send a letter to Mom is not a crime, but using it to send drugs is mail fraud. Likewise, using the dollar to purchase flowers for Mom is perfectly fine, but using dollars (or bitcoin) to purchase narcotics is a crime. Despite criminal use, no one is calling for the ban of roads, the internet, the postal service, etc. And you definitely do not see any prominent defenders of the public interest calling for a ban of the dollar, which just happens to be the preferred funding currency of criminals everywhere. While fear of criminal activity has consistently been used to infringe on the rights of law-abiding citizens, believing bitcoin should be banned because drug dealers use it would be no different than calling for a ban on the dollar for the same reason.

Missing the Point

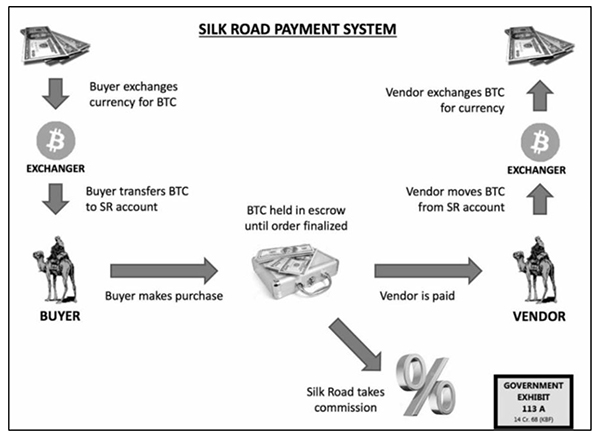

The fact that criminals can use (and[]{#_idTextAnchor126} have used) bitcoin to facilitate commerce demonstrates that bitcoin can be used to facilitate any form of commerce. Any other conclusion has a logical gap and simply assumes bitcoin was used for the reason of the illicit purpose. The Silk Road, a website that facilitated transactions involving drugs and other illicit goods using bitcoin as a means of payment, was a very early and well-publicized example. However, the Silk Road merely demonstrated that bitcoin worked. But rather than focus on the more fundamental reasons why, bitcoin research often attempts to prove the counterfactual—that bitcoin is not for criminals— by establishing that only a small percentage of bitcoin transactions facilitate illicit trade. For example, here is a recent headline from a bitcoin advocacy group:

A new study finds less than 1% of bitcoin transactions to exchanges are illicit.

The substance may be true, but these counternarratives fight the battle along the wrong lines. If the Silk Road demonstrated anything, it was simply that individuals would accept bitcoin as a form of payment in return for goods and services. It does not matter that the goods sold on the marketplace were generally illicit. The Silk Road, which facilitated more than one billion dollars of transactions between almost one million users,[57] was one of the earliest demonstrations of a mass real-world use case for bitcoin. So yes, bitcoin is (and was) used for drug deals, but it is merely one use case that has helped prove bitcoin’s general utility, nothing more. And when it comes to buying drugs, the dollar remains by far the preferred method of payment over bitcoin despite all drug dealers generally being capable of accepting it. Denying that would be denying the obvious reality, but the rhetorical question to ask is “why?” Whether in response to the Silk Road or otherwise, anyone who comes away with the narrow conclusion that bitcoin works principally for illicit transactions is failing to see the forest for the trees. The more consequential and assumption-shattering implication is simply that bitcoin works. Period.

If bitcoin could work for drug dealers to facilitate commerce, could it not “work” to facilitate any other form of commerce? It does not require much imagination to carry forward the logic. If Person A would accept bitcoin for Good B, is it possible that any person might be willing to accept bitcoin for any good regardless of who or what? In the case of the Silk Road, drug dealers may not have fully understood why bitcoin “worked,” but it worked well enough that they were willing to trade drugs for it. What they seemingly understood was that there was sufficient market demand for bitcoin to make it viable as a medium of exchange. And because it provided an electronic mechanism to facilitate transactions, it opened up a market and market mechanism that may have otherwise been unavailable. Love it or hate it, it was just a market taking advantage of new technology.

Source: Silk Road Payment System, government submitted exhibit

in the United States of America v. Ross William Ulbricht, 2015

Despite the existence of bitcoin, drug dealers have not magically stopped accepting dollars as their preferred funding currency. Nor have they stopped laundering dollars back into the banking system. Drug dealers on the Silk Road did not use bitcoin merely to evade law enforcement, nor did the dollar drug trade suddenly disappear. Bitcoin was used because it was functional and satisfied a market need. If bitcoin were not functional and could not be expected to hold a certain threshold of value over a particular time horizon, it would not have been used as a medium of exchange. After all, drug dealers are not in the money-losing business. But more importantly, any time anyone decries that criminals use bitcoin for illicit purposes, whether it be a US senator or a Treasury secretary, the default question to ask should be: why does bitcoin work as a medium to facilitate commerce in the first place?

The Litmus Test

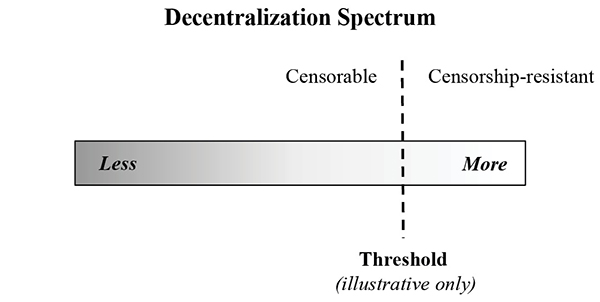

Focusing on criminals distracts from th[]{#_idTextAnchor127}e more fundamental question and consequence. If bitcoin could work for a criminal, it could work for anyone, and for bitcoin to be viable as a currency, it has to work for everyone, including criminals. However, this is not a promotion of criminal activity using bitcoin as a funding mechanism. It is merely a recognition of the properties that allow bitcoin to function in the first place. Think of criminal activity as a litmus test. If bitcoin doesn’t work for drug dealers, it doesn’t work for anyone. But if it works for drug dealers, it can work for everyone. If it were possible to censor (or prevent) bitcoin transactions related to certain activities or individuals, it would be possible to censor any activity and any individuals. And if there were a prime target of activities or individuals to censor, it would be that of a criminal enterprise. Such attempts have already begun.

The U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) has sanctioned three Chinese nationals and their cryptocurrency addresses, alleging they violated money laundering and drug smuggling laws. […] The agency also listed a number of bitcoin addresses […] that the agency claims belong to the Chinese citizens.

Recognize that bitcoin “working” is specifically a reference to the network protocol layer. Whether a company or individual is willing to accept bitcoin from an address sanctioned by OFAC or whether a third-party financial institution freezes an account associated with such an address is of little consequence to the long-term viability of bitcoin. What is consequential is whether the network would validate a transaction originating from a sanctioned address or validate a block that includes such a transaction despite it otherwise being valid based on the network’s consensus rules—stated another way, whether bitcoin miners or nodes would reject such a transaction. Bitcoin is only viable as a currency because it has achieved a sufficient threshold of decentralization. But decentralization is not an end in itself. The end game is censorship resistance, and it is not to protect criminals. It is an end game to protect the fundamental function of the currency system.

Censorship Resistance: All or Nothing

Censorship resistance is the network’s most critical property. It ensures that the rules of the network will neither change arbitrarily nor be enforced inconsistently, without which the system would be inoperable. The most important of these rules is the finite scarcity of the currency itself. Censorship resistance reinforces scarcity, and scarcity reinforces censorship resistance. Bitcoin becomes more resistant to censorship as it scales because the network becomes more decentralized over time. As adoption increases, each individual (on average) controls an ever-diminishing share of the network’s fixed supply, and it is the scarcity of the currency which primarily drives adoption. As the network becomes further decentralized, it becomes increasingly difficult for any individual or business to censor the network. However, at any point in time, whether bitcoin is sufficiently censorship-resistant is ultimately unknown and practically unknowable. Instead, censorship resistance can only be measured through the test of time and through each failed attempt to censor the network.

From a practical perspective, the risk of censorship principally comes in two forms: forcing changes to the network’s consensus rules and invalidating (or preventing) otherwise valid transactions. By design, anyone can access the bitcoin network on a permissionless basis by running a bitcoin full node. Each node can broadcast transactions to the rest of the network, and every node validates a full history of the bitcoin blockchain with each passing block based on a common set of rules.

Through this operation, nodes distributed throughout the world are able to come to a common consensus regarding the valid state of bitcoin ownership across the network, on a decentralized basis and without anyone trusting any other participant. The consensus rules of bitcoin are the common language that coordinates all peers within the network, but no single party dictates the rules, and everyone opts in voluntarily. If a single party or central authority were able to force a change to the network or to influence activity within the network in such a way that would invalidate an otherwise valid transaction, it would demonstrate that the network was not sufficiently decentralized to prevent censorship.

What does all of this have to do with criminal use? If it were possible to censor criminal-related activity within the network, either by inhibiting access to the network or by preventing otherwise valid transactions from being confirmed, it would demonstrate that it is possible to censor any activity. The bitcoin network has no understanding of criminality or who defines it. It is amoral and apolitical. All bitcoin understands (when validating transactions) is its consensus rules. It is a closed-loop system. A bitcoin transaction is valid if it is consistent with the network’s consensus rules. If it were not, all bets would be off. If any activity within the network could be censored, it would establish that the network as a whole would be censorable, and the network’s consensus rules would also be at risk.

Censorship resistance is an all-or-nothing proposition. It either is or it is not. And if it is not, then everything is at risk, including bitcoin’s fixed 21 million supply. That number and the reliability of its scarcity underpin every other economic incentive that allows the bitcoin network to function and accumulate value, including the mechanism by which the network comes to consensus. Accepting that the bitcoin network will to some extent always be used for illicit purposes is not just a libertarian bent. Instead, it is a recognition that for bitcoin to be functional and viable as a currency system, it must be so for everyone. If anyone could prevent anyone else from utilizing the network (whether it be an individual, an organization, or a nation-state), bitcoin would be at risk of failure. Censorship within bitcoin at the protocol layer is not the equivalent of PayPal deplatforming a user, nor is it akin to Bank of America closing a checking account or Visa refusing to authorize a transaction. Bitcoin is a currency issuer and settlement layer. Any effective form of censorship would undermine the system as a whole. Hence, the activity most susceptible to censorship forms a litmus test for the rest of the network. If it were not possible to censor the most at-risk activity, it reinforces that bitcoin reliably works in all cases.

Bitcoin Is for Everyone

Ultimately, bitcoin represents a []{#_idTextAnchor129}technological advancement in the global competition for money. It is the superior successor to existing fiat monetary systems, even if it is not well or widely understood today. Calling for a ban on bitcoin based on the belief that it enables criminal activity is concurrently admitting that bitcoin is functional as a currency. Consequently, if bitcoin is functional in facilitating commerce associated with illicit activities despite the best efforts of all-powerful regulatory authorities, it can be functional in facilitating any other form of commerce, including that of law-abiding citizens. It does not logically follow that its use will be confined to the dark web, nor is it today.

It is more important that innocence be protected than it is that guilt be punished, for guilt and crimes are so frequent in this world that they cannot all be punished. But if innocence itself is brought to the bar and condemned, perhaps to die, then the citizen will say, “whether I do good or whether I do evil is immaterial, for innocence itself is no protection,” and if such an idea as that were to take hold in the mind of the citizen that would be the end of security whatsoever.

The competition for bitcoin is global. Over time, those that produce the most relative value will accumulate the greatest share of bitcoin. To think that those involved in illicit activities will account for a larger share of the future bitcoin economy than today’s dollar economy is not rational. And calling for a ban on bitcoin is like being afraid of your own shadow. Not only would it be impractical to enforce, but the activity such a policy would seek to prevent is enabled today in far greater proportions by the dollar. It would be analogous to throwing the baby out with the bathwater. In bitcoin, you must accept the good with the bad, recognizing that no one gets to decide due to the very nature of bitcoin. There are always trade-offs. In this case, any rational person would gladly accept that bitcoin will inevitably be used for illicit purposes as a trade-off in exchange for the economic stability that an unmanipulable global currency will provide. As with every technology, value will accrue to those who utilize bitcoin in its highest and best use, a function that only the market can determine. The net benefit will not be zero-sum. And just as the internet is not for criminals, neither is bitcoin. It is for everyone.

-

Joe Manchin III, “Manchin Demands Federal Regulators Ban Bitcoin,” press release, 26 February 2014. ↩

-

Neeraj Agrawal, “A New Study Finds Less Than 1% of Bitcoin Transactions to Exchanges Are Illicit,” Coin Center, 17 January 2018. ↩

-

US Attorney’s Office, District of Oregon, “Silk Road Methamphetamine Distributors Indicted in Federal Case Involving Four Defendants,” press release, 18 December 2013, updated 29 January 2015. ↩

-

Nikhilesh De, “US Treasury Blacklists Bitcoin, Litecoin Addresses of Chinese Drug Kingpins,” CoinDesk, 21 August 2019. ↩

-

John Adams, “Argument for the Defense,” The Trial of William Wemms, James Hartegan, William M’Cauley…for the Murder of Crispus Attucks…Superior Court of Judicature, Court of Assize, and General Goal Delivery, Boston, 3–4 December 1770. ↩