Chapter Four

Bitcoin Is Antifragile

(Originally published on 12 June 2020)

Lacking a Baseline

If one thing is certain, it is that bitcoin is humbling. It humbles everyone—some sooner than others, but everyone eventually. Individuals you respect have likely called bitcoin a fraud or compared it to rat poison, but rest assured. If it hasn’t been walked back yet, it will be in time. For most everyone first considering bitcoin, the proper context to evaluate it is practically nonexistent, which even applies to the most revered financiers of our time—like Warren Buffett. Is bitcoin like a stock, bond, tech startup, the internet, or merely a figment of everyone’s imagination? At first glance, bitcoin admittedly makes very little sense. It is very reasonably believed by many to be one massive collective hallucination. There are two fundamental reasons: almost everyone lacks a baseline to evaluate bitcoin because there has never been anything like it, and very few people have ever consciously considered what money is.

Every day, people evaluate whether to invest in stocks, bonds, or real estate, whether to buy a home or car, whether to purchase some consumer good, or conversely, whether to save. While there are exceptions to every rule, practically everyone is unequipped to evaluate bitcoin because it does not fit any existing mental framework. It is like asking someone with no concept of mathematics what two plus two equals. The answer may be obvious to those who know math, but for those who do not, it’s wholly unrelatable. As an idea and application, bitcoin is incredibly abstract, largely because money is abstract. Trying to understand it can feel like staring into the abyss. Bitcoin is both difficult to see yet impossible to unsee once discovered. And the path from one extreme to the other is most often a journey, where the impossible first becomes possible, then probable, and ultimately inevitable for each individual.

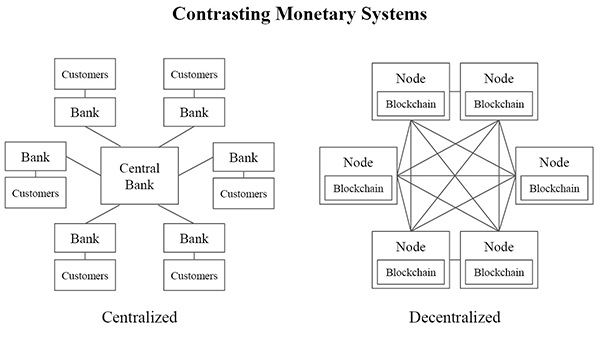

Eventually, some chord is struck, and dots are connected. As the fog begins to lift, there naturally remains the idea that while bitcoin is possible, it is surely subject to high degrees of chance and more likely to fail than succeed. It is perceived to be inherently fragile and risky. Many believe that bitcoin could vanish as quickly as it appeared on the scene. At the beginning of the journey, it seems to live somewhere between an aspiring long shot and just one unidentified silver bullet away from complete and utter collapse. Bitcoin is novel and often thought of as untested and unproven. Launched in 2009, it seemingly lacks permanence. It is not yet anchored in history. At the same time, bitcoin has been around for twelve years—as of the time of writing—and has a total purchasing power (or value) of $180 billion. With more than a decade of operating history and hundreds of billions in value, bitcoin may still be an upstart, but it is far from untested and unproven. In reality, bitcoin is thriving in the wild without any central coordination, and it is the lack of central coordination from which bitcoin gets its lifeblood. Decentralization not only allows bitcoin to function but also causes it to gain strength rather than falter when stressed.

Bitcoin is natively digital and powered by computers running software capable of being shut down, which lends to the default impression that bitcoin is inherently fragile. The mental image of a computer network being unplugged creates the false sense that bitcoin as a system could suddenly cease to exist, when the opposite is true for the very same reason. Bitcoin exists everywhere and nowhere. No one controls it, anyone can run bitcoin’s open-source software from anywhere, hundreds of thousands of people do, and it’s relied upon by a network of tens of millions (and growing). Decentralization gives bitcoin permanence. With no single point of failure, bitcoin is practically impossible to stop because it is impossible to control. It is a dynamic system that only becomes more redundant and further decentralized in time and with increasing adoption. In short, bitcoin is more permanent than risky because it is an antifragile system. Antifragile, an idea popularized by Nassim Taleb in his 2012 book of the same name, describes systems or phenomena that gain strength from disorder, which bitcoin is to its core. There is no silver bullet that can kill bitcoin. There is no competitor that can magically overtake it. There is no government or corporation that can shut it down. But it does not stop there. Each attack vector and shock to the system actually causes bitcoin to become stronger.

Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty. Yet, in spite of the ubiquity of the phenomenon, there is no word for the exact opposite of fragile. Let us call it antifragile. Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better. This property is behind everything that has changed with time: evolution, culture, ideas, revolutions, political systems, technological innovation, cultural and economic success, corporate survival, good recipes (say, chicken soup or steak tartare with a drop of cognac), the rise of cities, cultures, legal systems, equatorial forests, bacterial resistance … even our own existence as a species on this planet. And antifragility determines the boundary between what is living and organic (or complex), say, the human body, and what is inert, say, a physical object like the stapler on your desk. […] The antifragile loves randomness and uncertainty, which also means—crucially—a love of errors, a certain class of errors.

A Positive Feedback Loop

Bitcoin is an adaptive and evolving system. It is not static. No one controls the network, and there are no leaders capable of forcing changes onto the network. It is decentralized at every layer, and as a result, it has shown itself to be immune to attack. However, it is not just immune. Bitcoin actually becomes stronger as:

- External forces attempt to influence or co-opt the network;

- Individuals make errors within the network; or

- As a function of its volatility—a trait often perceived as a limiting or critical flaw.

As bitcoin survives shocks and as individuals learn from their errors and adapt to its volatility, bitcoin becomes tangibly more reliable. The network’s demonstration of resilience and immunity reinforces trust in the network, which drives incremental adoption and makes bitcoin more resistant to future attacks or individual errors. It is a positive feedback loop. With every failed attempt to co-opt or coerce the network, the bitcoin protocol hardens, and confidence increases. Every time bitcoin survives an attack, it is propelled forward in a fundamentally stronger state.

Each exogenous shock to the network provides learnings that cause bitcoin to adapt in spontaneous ways that can only be endemic to a decentralized system. Because bitcoin is decentralized and becomes increasingly decentralized with time (and adoption), not only is there no single point of failure, but the increasing levels of redundancy ensure network survival and fortify it against future attacks. There is a positive correlation between time and the degree of network decentralization. Similarly, there is a positive correlation between the degree of decentralization and the network’s ability to fend off more formidable attacks. Essentially, as the network becomes more decentralized, it also becomes resistant to threats it may not have been capable of surviving in prior states.

As bitcoin grows, each potential point of failure becomes less critical to the proper functioning of the network as a whole. Errors made by individuals are isolated to the responsible parties, weak points in the network are sacrificed, and the system strengthens in aggregate. The entire process is effective and efficient because it is never a conscious decision but simply structural to the system architecture. No one picks winners and losers. At all times, network participants are maximally accountable for their own errors. There are no bailouts. Decentralization simultaneously eliminates moral hazard and ensures system survival. Incentives and accountability optimize for innovation and naturally drive toward consistently better outcomes. While the incentive structure doesn’t eliminate error, it ensures that errors are productive, allowing the network to adapt to threats and immunize around them. Whether borne from exogenous shocks or individual errors, bitcoin feeds on disorder, stressors, volatility, and randomness. Collectively, these are the hallmarks of an antifragile system.

Bitcoin Benefits from Disorder

The lack of social order in bitcoin may be its single greatest asset. There is no CEO of bitcoin, nor is there a centralized authority that controls it. There is no person or organization to drag in front of Congress, whether to answer questions or compel action. In fact, there is no Congress or legislative body with any influence over bitcoin, preferential or otherwise. It does not mean that any individual or company is immune from influence. Nor does it prevent any country from attempting to regulate (or ban) bitcoin, but disorder insulates the network from external threats. While Facebook’s Libra is fundamentally plagued as a currency for reasons independent of government influence, the CEO and other top executives were quickly brought before Congress to answer questions soon after its announcement, with key legislators demanding the project be delayed, if not scrapped, over concerns of “national security” and other regulatory issues.[9] It is not that CEOs and companies cannot coexist with government. Instead, it is that the mere existence—of governments, CEOs and companies—creates influence that could never exist in bitcoin at a protocol level, and the absence of which allows bitcoin to be viable as a currency.

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.

With no central counterparties controlling the network, bitcoin functions on a decentralized basis and in a state that eliminates the need for, or dependence on, trust. Its distributed architecture reduces the network’s attack surface by removing single points of failure that would otherwise expose the system to critical risk. Built on a foundation of social disorder, it is only in the absence of control that bitcoin is able to function on a secure basis. It is the polar opposite of the central bank trust-based model. Bitcoin is a monetary system built on a market consensus mechanism, rather than centralized control. There are certain consensus rules that govern the network. Each participant opts in voluntarily and everyone independently enforces the rules. If any market participant changes a rule to be inconsistent with the rest of the network, that participant falls out of consensus. The network consensus rules ultimately define what is and is not a bitcoin. Independent verification and the aggregate network enforcement function, on a decentralized basis, ensures there will be only 21 million bitcoin. By eliminating trust in centralized counterparties, all network participants can rely upon and ultimately trust that the monetary policy is secure and that it will not be subject to arbitrary change. This may seem paradoxical, but it is perfectly rational. The system is trusted because it is trustless, and it would not be trustless without high degrees of social disorder. Ultimately, spontaneous order emerges from disorder and strengthens as each exogenous system shock is absorbed.

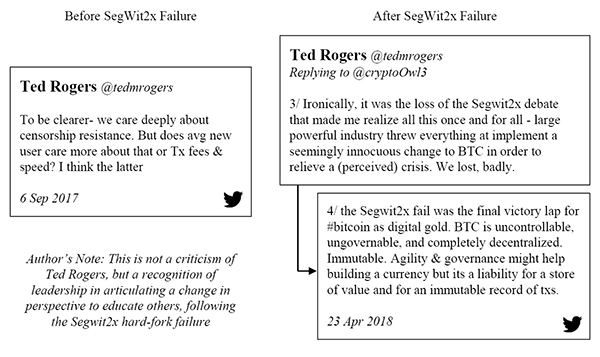

In 2017, a civil war of sorts emerged in bitcoin. Many of the largest companies that provide bitcoin custody and exchange services aligned with many of the largest bitcoin miners (collectively controlling >85% of the network’s mining capacity) in an attempt to force a change to the consensus rules. This group of power brokers wanted to double the bitcoin block size as a means to increase the network’s transaction capacity. However, the proposal required a change to the network’s consensus rules, which would have resulted in a split (or hard fork) of the network. As part of a negotiated “agreement,” the group proposed to activate a significant network upgrade (referred to as SegWit, an upgrade that would not change the consensus rules). And at the same time, the block size would also be doubled (which would have changed the consensus rules). Virtually all large service providers and miners were publicly on board, and plans were set in motion to effect the changes. However, a curveball was thrown when a user-led effort prompted the activation of the SegWit network upgrade without changing the network consensus rules and without increasing the block size.[11] The effort to change the network’s consensus rules failed miserably, and bitcoin steadily marched forward undisturbed. In practice, it often cannot be known whether bitcoin is resistant to various threats until the threats present themselves. In this case, disorder prevented coordinated forces from influencing the network, and everyone learned the extent to which bitcoin was resistant to censorship, further strengthening the network.

This episode in bitcoin’s history demonstrated that no one had unilateral control over the network—not even the most powerful companies and miners working in concert could alter bitcoin. It was an incontrovertible demonstration of the network’s resistance to censorship. While most participants likely supported the increase in the block size (or at least the idea), it was always a marginal issue. And when it comes to change, bitcoin’s default position is no, even for seemingly inconsequential changes. Only an overwhelming majority of all participants (naturally with competing priorities) can change the network’s consensus rules. In this instance, it was not really a debate about block size or transaction capacity—but instead whether bitcoin was sufficiently decentralized to prevent external forces from influencing the network and changing the consensus rules. If bitcoin had been susceptible to change by the dictate of a few centralized companies and miners, it would have established that bitcoin was censorable, which is a slippery slope. There would have been no reason to believe that other changes would not be forced upon the network in the future. Ultimately, it would have severely impaired the credibility of bitcoin’s fixed 21 million supply.

The most powerful players in bitcoin colluded, yet failed to co-opt the network because of decentralization. Bitcoin was not just resilient. It emerged stronger as a result. It reinforced bitcoin’s long-term viability. The entire network was educated on the importance of censorship resistance and witnessed just how uncensorable bitcoin had become. The lesson informs future behavior as the economic costs and consequences are both real and permanent. Resources to support the effort became sunk costs, reputations were damaged, and costly trades were made. All said, confidence in bitcoin increased as a function of the failed attempt to control the network, and confidence is not just a passive descriptor. The lessons learned from this attack dissuade future attempts to co-opt the network and drives adoption of bitcoin. Increasing adoption further decentralizes the network, making it more resistant to censorship and outside influence. It may seem like chaos, but social disorder was and will continue to be an asset that secures the network from unpredictable and undesired change.

Bitcoin Benefits from Stressors

Attempts to influence the network consensus rules may be the most acute stressor—as it is these rules that underpin the entire system and create order out of disorder—but bitcoin is consistently exposed to a myriad of smaller stressors that similarly strengthen the network as a whole and over time. There are many different forms of stress, but because bitcoin is exposed to a wide variety of stressors on a consistent basis, the network is forced to constantly adapt and evolve while also building its immune system from the outside in.

Each form of stress hardens the bitcoin network and often for different reasons. Whenever governments take action in an attempt to ban or otherwise restrict the use of bitcoin, the network continues to function unperturbed. With a combined population of 2.7 billion people, the governments of China and India have both taken material actions to curb the spread of bitcoin. Despite this, the network continues to function without flaw, and the use of bitcoin continues in both countries. After the Reserve Bank of India restricted the ability of banks to service bitcoin or cryptocurrency-related companies, the Supreme Court of India eventually overturned the ban as unconstitutional. It set a precedent in more ways than one. First, the central bank was overruled. Second, the ban was ultimately unsuccessful as people continued to find ways to access bitcoin. Third, the network was unfazed despite these actions.

| Stressor | Example | Impact / Outcome |

|---|---|---|

| Consensus rules |

|

|

| Government action |

|

|

| Competing protocols |

|

|

| Company or service provider error |

|

|

| Individual user error |

|

|

Source: Bloomberg

Separately, China has taken measures to restrict the ability of exchanges to facilitate bitcoin trading and has expressed an interest in eliminating bitcoin mining. As they do in India, people continue to use bitcoin in China with no disruption to the network. Naturally, as government regulation in China has become more restrictive, miners have begun to look to more stable jurisdictions. Bitcoin mining in the United States (among other regions) continues to grow, with Peter Thiel recently backing a startup building out mining operations in West Texas.[12] Regardless of the threat, bitcoin exists beyond countries (and governments). The network organically adapts to jurisdictional risks and continues to function without interruption. As network participants observe the failed attempts to inhibit bitcoin’s growth and witness how it adapts, bitcoin does not merely remain static. It actually becomes more resilient through this process by routing around and immunizing each passing threat.

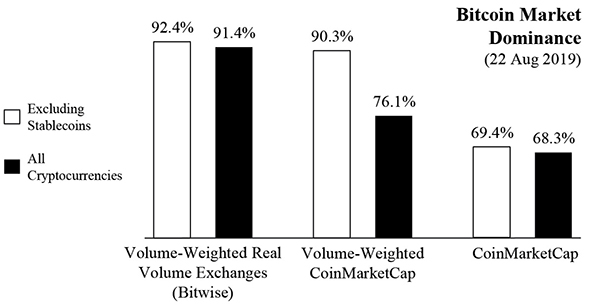

An entirely different type of stress comes in the form of competing cryptocurrencies. There have been thousands of variations following bitcoin’s launch in 2009, often espousing different purposes and “use cases.” In reality, every single one has been competing with bitcoin as money (whether it is realized or not). Creators will call out perceived flaws in bitcoin and explain how their competing protocol intends to improve on its “limitations.” However, despite thousands of competitors, bitcoin accounts for ~70% of all cryptocurrencies in terms of market value. And when adjusted for liquidity, the estimate is closer to ~90%. Meaning thousands of competing cryptocurrencies account for 10% to 30%.

Source: Arcane Research

That is the market distinguishing between bitcoin and the field. Competition is inherently good for bitcoin. Not only does each attempt to create a better bitcoin fail, but the repeated failures inform market participants that there is something that differentiates bitcoin. Even if the reason is not immediately self-evident, the market still provides valuable information. Bitcoin does not just withstand the competition. It beats the competition. The market test teaches people that bitcoin cannot be copied better than any amount of reason and logic can. Through the failed experiences of competing currencies, bitcoin accumulates more human capital and a larger holder base, with the network growing as a direct result. If bitcoin were never tested or challenged, it would not have the opportunity to benefit from stress.

While external threats to the network create positive externalities, bitcoin also benefits from more frequent and consistent internal stressors, such as malicious attacks or unintentional errors. Attacks aimed at participants (whether an individual or company) occur at a near-constant clip. Each participant is maximally and independently responsible for the security of their bitcoin holdings, whether choosing to trust a third party or directly assuming that responsibility. Many of the largest exchanges in the world have been hacked, as have numerous individuals within the network. For those that have not, the threat always exists. As participants are compromised, hacked, or otherwise have access to their bitcoin restricted, it does not impact the functioning of the network. But like all stressors, the threats directly cause the network to adapt to these vectors and become stronger.

Your keys, your bitcoin. Not your keys, not your bitcoin.

With each critical exchange failure or hack, market participants increasingly shift to taking on the responsibility of holding their own bitcoin, independent of third-party service providers. The same is true in response to individual accounts at exchanges getting hacked. Similarly, as threats are identified by those who secure their own bitcoin, more secure wallets are developed, and users opt toward methods that reduce or eliminate single points of failure. Because everyone is personally accountable and no cost of error can be socialized, the incentive structure dictates that participants constantly seek out better ways of securing bitcoin. It is a constant evolution born out of the reality that stressors exist everywhere. The network is not exposed to critical failures because the entire universe of market participants iterates through trial and error around the clock and at every level. Open competition and endless market opportunities incentivize innovation—the network benefits as a whole, strengthening naturally and organically.

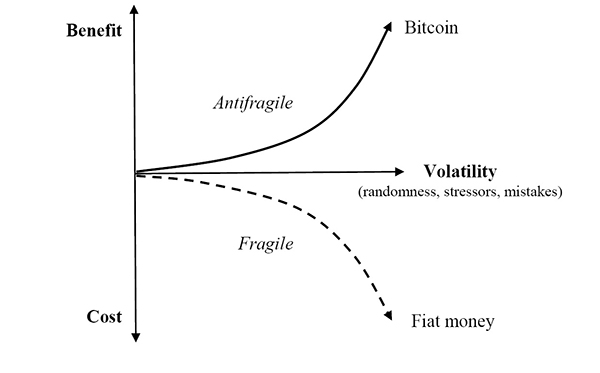

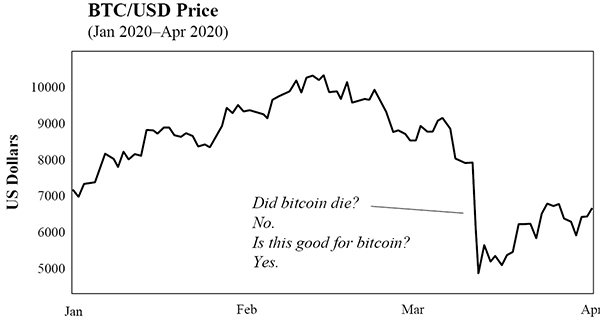

Bitcoin Benefits from Volatility

Similar to the benefit provided by consistent stressors, volatility tangibly builds the system’s immunity. While often lamented as a critical flaw, volatility is a feature, not a bug. Volatility is price discovery, and in bitcoin, it is unceasing and uninterrupted. There are no Fed market operations to rescue investors, nor are there circuit breakers. Everyone is individually responsible for managing volatility, and there is no one to offer bailouts. Moral hazard is eliminated network wide. In a world without bailouts, the market function of price discovery is far truer because external forces cannot directly manipulate it. Through experience, market participants quickly learn how unforgiving volatility can be. It is akin to a child touching a hot stove, a mistake that will likely only happen once. And should the lesson go unheeded, the individual is sacrificed to benefit the whole. There is no “too big to fail” in bitcoin. Ultimately, price communicates information. All participants independently observe and navigate market forces, either adapting or individually paying the price.

However, information is not just communicated through price volatility. Volatility is also how bitcoin gets distributed. Every bitcoin sold is a bitcoin bought. Consistently over time, the ownership of the network becomes more decentralized, and bouts of volatility result in greater distribution with large volumes of the currency changing hands. As the network becomes more decentralized, it similarly becomes more censorship-resistant. As each individual within the network holds a smaller and smaller share of the currency (on average) over time, it results in a dynamic where price is decreasingly dependent on the preferences of a few large holders. This is not to say that there are no large holders remaining that can singularly influence price and volatility. But as a directional trend, any individual participant’s impact on price diminishes over time, often directly through the distributive function of volatility. In very tangible ways, volatility strengthens bitcoin.

Price Source: Bitstamp

When network participants, individually and as a whole, observe bitcoin’s continued survival, especially following extreme downside volatility, confidence in the network strengthens. At some price, individuals are willing to step in and catch the falling knife. Through these episodes, bitcoin accumulates more human capital. The weak hands get shaken out, but the strongest hands survive (often in the form of new holders), causing the network to become more resilient. Bitcoin does not merely remain static or simply absorb the disruption. It actively feeds on the chaos. In the end, near-term volatility directly contributes to long-term stability. By maintaining a fixed supply with highly variable present demand, the market performs price discovery twenty-four hours a day, seven days a week. The intermittent stress trains and hardens all individual owners, which prevents the network from being exposed to systemic risk. All the while, the opposite is true of fiat currencies. Central banks maintain short-term stability by suppressing volatility. The consequence is the accumulation of imbalances below the surface, leading to fragility. These policies all but ensure more severe systemic shocks in the long term, as has been witnessed with increasing regularity over the last two decades. Volatility in bitcoin benefits participants by communicating information with the least distortion. The contrast between the two competing systems could not be more extreme. Without volatility today, long-term stability would not be possible.

Complex systems that have artificially suppressed volatility tend to become extremely fragile, while at the same time exhibiting no visible risks. […] Such environments eventually experience massive blowups, catching everyone off-guard and undoing years of stability.

Variation is information. When there is no variation, there is no information […] there is no freedom without noise—and no stability without volatility.

Bitcoin Benefits from Randomness

Many of the greatest things man has achieved are the result not of consciously directed thought, and still less the product of a deliberately coordinated effort of many individuals, but of a process in which the individual plays a part which he can never fully understand. They are greater than any individual precisely because they result from the combination of knowledge more extensive than a single mind can master.

While most people recognize that there is intelligent design in bitcoin’s foundation, the element of randomness in its evolution is often overlooked. What bitcoin has evolved to become (money) is largely a function of that randomness. Lightning was caught in a bottle. It resulted from thousands of people making thousands of independent decisions very early on—a process that continues to this day—from cryptographers and developers contributing time and energy to companies and investors building infrastructure to users just wanting to find a better way to store value. If someone magically pressed a reset button going back to 2008, when the bitcoin white paper was published, and the same initial code were released, placing the same people in the same rooms, bitcoin would very likely not be what it is today. It may be “better” or “worse,” but ultimately, bitcoin was and continues to be a product of randomness. It is not the product of consciously directed or controlled thought, and it expands beyond the resources of individual minds because of that fact. For those who perceive flaws in bitcoin and have (or had) ideas of how to improve upon it, the intelligence of bitcoin’s design is often observed and acknowledged. While you can copy the design and change individual features, you cannot replicate the conditions and subsequent randomness.

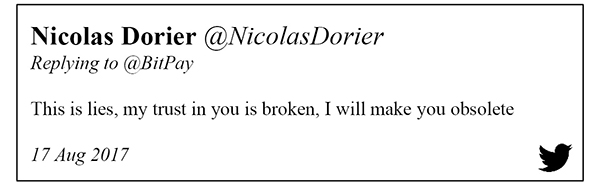

One week after the launch of bitcoin, Hal Finney famously tweeted to the world that he was “running bitcoin,” becoming the first known person to join the network after its launch. In 2011, Ross Ulbricht was alleged to have created the Silk Road marketplace. This website ultimately leveraged bitcoin to facilitate online payments for drugs, establishing one of the earliest widespread uses of bitcoin in commerce and undoubtedly playing a material role in expanding early adoption and awareness. In 2014, the Tokyo-based bitcoin exchange Mt. Gox was hacked, and that event may have had the single greatest influence on the advancement and proliferation of bitcoin hardware wallets as individuals and companies looked to eliminate the risks posed by third-party exchanges. In 2017, after a bitcoin service provider drew the ire of Nicolas Dorier, he set out to build a product that would obsolete that provider and service, spawning one of the most exciting open-source projects within bitcoin, the self-hosted payment processor BTCPay Server.

Source: Bloomberg

In 2018, Saifedean Ammous released the book The Bitcoin Standard, which has accelerated knowledge distribution and contributed to a wave of bitcoin adoption. There are obviously too many random acts to count or acknowledge. Still, the randomness derived from bitcoin’s permissionless nature, lacking any conscious control, allowed it to evolve into the antifragile system it is today. Bitcoin would have never been viable as a currency if it was under the direction of any single individual, company, or country. If it had been, bitcoin would have always been dependent on trust and would have lacked the randomness necessary to create a system capable of dispensing with the need for conscious control. Randomness is irreplicable, and the foundation of bitcoin was built on it.

Bitcoin Is Antifragile

In aggregate, bitcoin benefits from disorder as both a currency and economic system. The constant exposure to stressors, volatility, and randomness causes bitcoin to evolve and adapt. It ultimately becomes stronger in a near-uniform fashion and in a way that would not be possible in the absence of disorder. Bitcoin may still be young, but it is not temporary. It was released into the wild, and a system has spawned that cannot be controlled or shut down. Like an elusive ghost, it is both everywhere and nowhere simultaneously. Its decentralized and permissionless nature eliminates single points of failure and incentivizes innovation, ultimately ensuring both its survival and a constant strengthening of its immune system as a function of time, trial, and error.

Beyond resilient, bitcoin does not just absorb shocks. It gets better as a direct result. While it is easy to fall into the trap of believing bitcoin to be untested, unproven, and not permanent, it is precisely the opposite. Bitcoin has been tested constantly for twelve years (as of the time of writing), each time not only proving it was up to the challenge but emerging in a stronger state. At the end of the day, bitcoin is more permanent than risky because of its antifragility. As a currency system, it manages to extend the utilization of resources beyond the control of deliberately coordinated effort, entirely dispensing with the need for conscious control. Bitcoin is the antifragile competitor to the inherently fragile legacy monetary system. The legacy system is crippled by moral hazard and is dependent on trust and centralized control. Imbalances accumulate when exposed to stress and disorder, principally as a function of trillions in bailouts with each passing shock, further weakening its immune system and increasing its fragility. In contrast, bitcoin is a system devoid of moral hazard and operates flawlessly on a decentralized basis, without trust or bailouts. It eliminates imbalance and sources of fragility as a constant process, further strengthening the currency system as a whole. What doesn’t kill the legacy monetary system only makes it weaker. What doesn’t kill bitcoin only makes it stronger.

But those who clamor for “conscious direction”—and who cannot believe that anything which has evolved without design (and even without our understanding it) should solve problems which we should not be able to solve consciously—should remember this: The problem is precisely how to extend the span of our utilization of resources beyond the span of the control of any one mind; and therefore, how to dispense with the need of conscious control, and how to provide inducements which will make the individuals do the desirable things without anyone having to tell them what to do.

-

Nassim N. Taleb, Antifragile: Things That Gain from Disorder (Random House, 2012), 3. ↩

-

Hearing: An Examination of Facebook and its Impact on the Financial Services and Housing Sectors, Before the House Financial Services Committee, 116th Congress (23 October 2019) (questioning of Mark Zuckerberg, CEO and Chairman of Facebook). ↩

-

Satoshi Nakamoto, “Bitcoin Open Source Implementation of P2P Currency,” P2P Foundation, forum post, 11 February 2009. ↩

-

Phil Geiger, “Bitcoin Refuses to Centralize,” Keeping Stock (blog), Medium, 27 August 2018. ↩

-

Jeff John Roberts, “Texas Bitcoin Mining Startup Gets $50 Million From Peter Thiel to Steal China’s Crypto Crown,” Fortune, 15 October 2019. ↩

-

Olusegun Ogundeji, “Antonopoulos: Your Keys, Your Bitcoin. Not Your Keys, Not Your Bitcoin,” Cointelegraph, 10 August 2016. ↩

-

Nassim N. Taleb and Mark Blyth, “The Black Swan of Cairo: How Suppressing Volatility Makes the World Less Predictable and More Dangerous,” Foreign Affairs 90, no. 3 (May/June 2011). ↩

-

Friedrich A. Hayek, The Counter-Revolution of Science: Studies on the Abuse of Reason (Glencoe, IL: Free Press, 1952), 84-85. ↩

-

Friedrich A. Hayek, “The Use of Knowledge in Society,” American Economic Review 35, no. 4 (September 1945): 527. ↩